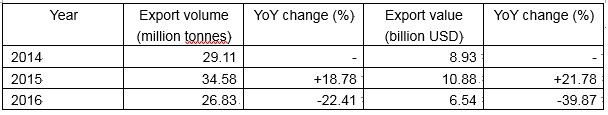

According to trade analysis firm Tranalysis, the export volume of fertiliser slumped down in 2016 with a decrease of 22.41% compared to 2015. Furthermore, Chinese manufacturers are not looking forward to the exports in 2017, which is due to higher production costs and resulting in less competitiveness on the world market for fertilisers.

Chinese exports of fertiliser, 2014-2016

Source: Tranalysis & China Customs

2008 was a remarkable year for China’s fertiliser manufacturers. In that year, the output of fertilisers, like diammonium phosphate, mono ammonium phosphate, superphosphate, urea, and ammonium sulphate, did surpass the domestic demand in China for the first time. This was the beginning of a booming export situation for Chinese producers, to sell their overcapacity overseas.

The profitable trend for these manufacturers went on till 2015. In that year, the peak of export volume and value was reached, showing the biggest growth of exports with an increasing value by 21.78% year on year, according to Tranalysis’ research. The biggest reasons for the enormous boom in 2015 were a changed tariff policy by China’s government as well as a growing gap of fertilisers output and domestic demand in China.

However, this trend came to an end in 2016, which witnessed a decrease of the export volume of fertilisers for the first time in eight years by 22.41% year on year. The largest drop in exports was seen for ammonium sulphate, whose export volume dropped by 35.6% to 8.86 million tonnes in 2016.

As a result of the sluggish export of fertilisers in 2016, China’s manufacturers had to suffer losses for the first time since many years. According to CCM, there are several reasons which back up the significant export drop in 2016.

First of all, the prices of field crops are a huge indicator for international fertiliser demand. When prices are high, farmers can make more profits and therefore demand on fertilisers to grow their crops. In 2016, the prices of field crops like grain has been pretty low, which reduced the demand for fertilisers accordingly.

In addition, the global output and capacity of fertilisers did rise again, which caused a fierce market competition and lowered the prices of manufacturers to keep some share of the world market. Chinese competitors even faced a worse situation in 2016, looking at increasing production costs while overseas manufacturers enjoyed some cost reductions. The increasing costs in China were caused by the abolishment of favourable policies for the fertilisers industry and rising prices of energy, transportation and raw materials. Overseas manufacturers took benefits from sinking gas prices on the world market.

What’s more, the situation of fertilisers export from China will hardly improve in 2017. The production costs for Chinese manufacturers are still higher than those of the competitors overseas. The global capacity of fertilisers will likely even increase, leading to a rising market competition. Even China’s government will adjust the export tariffs of fertilisers again to ease the situation of manufacturers, Tranalysis doesn’t expect any larger changes in the export business for 2017.

The main destination country for China’s fertilisers exports in 2016 have been the USA. The next ranks go to the European Union, Hong Kong, Japan, and Germany, according to Tradingeconomics.

About Tranalysis:

Tranalysis is an intelligence and analysis provider on import/export data covering over 15 industries in China. For more trade information of vitamins, including Import and Export analysis as well as Manufacturer to Buyer Tracking, contact our experts in trade analysis to get your answers today.

For more information about Tranalysis, please visit our website or get in touch with us directly by emailing econtact@tranalysis.com or calling +86-20-37616606.