At present, the global demand for titanium dioxide is gradually expanding. From 2013 to 2017, both the import volume and the export volume of titanium dioxide were increasing, on the whole, registering compound annual growth rates of 19.34% and 4.55%, respectively. This is mainly because the international market price of the product continued to rise, while the domestically made product had its advantages in both price and supply, and there was an increase in overseas demand for the product.

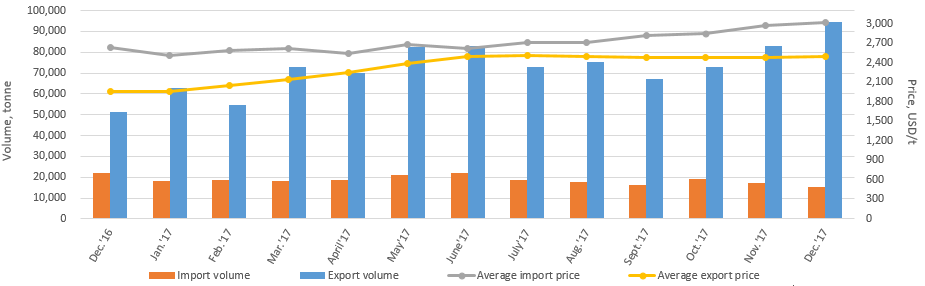

China’s imports and exports of TiO2, Dec. 2016 – Dec. 2017

Source: CCM

In December 2017, the export volume of titanium dioxide reached a record high. According to China Customs statistics, from January to June 2017 China exported a total of 426 thousand tonnes of titanium dioxide, an increase of 13.06%. From July to September is the off-season for the product, so the export volume declined, but rebounded from October and maintained an uptrend till the end of the year.

In the same month, China's top 5 exporters exported a total of 40,371 tonnes of TiO2, 42.72% of the total TiO2 exported by China. Sichuan Lomon continued to rank the first among all Chinese TiO2 exporters, exporting 13,563 tonnes and up by 0.11% MoM.

In terms of export destinations, China exported 36,359 tonnes of TiO2 to the Asia-Pacific Region; 21,302 tonnes to Europe; 17,420 tonnes to the Middle East; 10,349 tonnes to South America; 6,971 tonnes to North America and 2,094 tonnes to Africa.

It is understood that China used to be dependent on imports of titanium dioxide. Yet, as the country's production capacity of the product keeps going up and the product quality continuously improves, accompanied with prices lower than the international level, the homemade products are gradually replacing the imports.

In December 2017, Australia ranked the top source of imports, exporting a volume of 3,747 tonnes of TiO2 to China, up by 15.12% MoM. Taiwan, Japan, the USA and Germany followed, ranking the second, third, fourth and fifth respectively.

The top 20 Chinese TiO2 importers imported a total of 11,549 tonnes of TiO2 in the same month, 74.74% of the national figure. Of these companies, Chemours Chemical (Shanghai), ranked the first with an import volume of 4.187 tonnes, down by 27.41% MoM. Shanghai Sanchang Import & Export, Shanghai Interunited, Zhejiang Kingdecor and Ningbo Export ranked the second, third, fourth and fifth respectively.

What are the reasons behind the development?

China¹s TiO2 exports were booming in 2016. The continuously depreciating RMB and the increasing export scales of China¹s manufacturers have strengthened this development throughout the year. As a fact, many of China¹s producers exported their products at a lower price while achieving higher profit margins in the domestic market of TiO2.

The overseas demand for Chinese TiO2 rose up by about 17% in 2016, which enabled an export increase of the manufacturers in China. As a fact, Chinese TiO2 is highly demanded in overseas markets, due to the comparatively small price of the suppliers. The export of TiO2 is responsible for about one-third of the total output in China.

The reason why China's TiO2 prices were able to remain high in 2017 can be found in favourable exports. Large demand from overseas markets helped the price to keep at a high level. Statistics show that China exported 892,200 tonnes of TiO2 in 2017, up by 16.86% YoY from 763,500 tonnes in 2016. This consecutive increase is mainly due to large price gap between domestic and overseas TiO2, especially after some international leading TiO2 manufacturers offered higher quotations. The price superiority of China's TiO2 products facilitated domestic companies to occupy larger markets abroad.

In terms of imports, China's TiO2 import volume declined by 5.81% YoY from 235,600 tonnes in 2016 to 221,900 tonnes in 2017. China usually imports approximately 200,000 tonnes of high-end TiO2, specialised for plastic, paper and printing ink production, annually from developed counties such as the USA, Australia, Japan, and Germany.

As for the TiO2 market in 2018, Lomon Billions, the leading TiO2 enterprise in China, gave the following comment during an interview. China's TiO2 supply and demand keep in balance. Given this, the company's sales remain stable during the current slack season. After the Chinese Spring Festival, the Chinese market will gradually recover owing to price hikes of some international TiO2 producers. Lomon Billions, later, will decide quotations and sales strategies based on raw material prices, production and market dynamics.

About Tranalysis

Tranalysis is an intelligence and analysis provider on import & export data covering over 15 industries in China.

For more information about Tranalysis and any enquiries please visit the website or get in touch with the team directly by emailing econtact@tranalysis.com or calling +86-20-37616606.