Tranalysis

This week, the Shanghai Main Board welcomes the application of leading enterprises in the sub-industries.

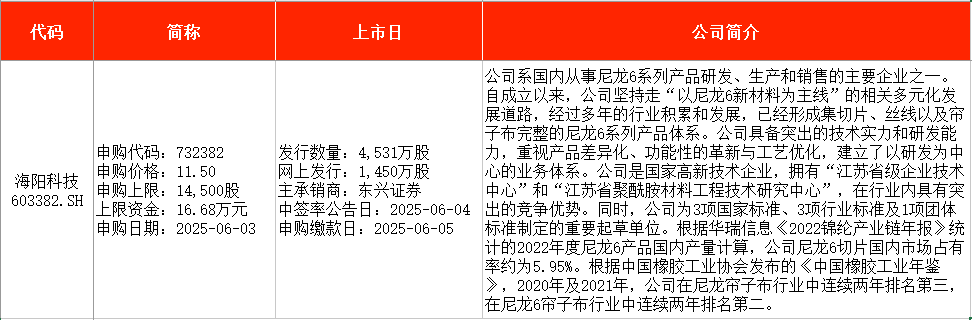

Pengpai News, based on Wind and public information, has sorted and counted that this week (from June 3 to June 6), there is 1 new stock scheduled for subscription, which is Haiyang Technology Co., Ltd. (hereinafter referred to as \Haiyang Technology\, 603382).

Public information shows that Haiyang Technology was established in the 1970s and is one of the main manufacturers of nylon 6 series products in China, with many products ranking at the forefront of the industry in terms of production and sales volume. In the field of nylon 6 chips, the company has entered the list of qualified suppliers of large domestic and foreign chemical companies such as BASF, Envalior, Hyosung Group, Kingfa Science & Technology, HuaDing Shares, and Aier, and has been supplying them for a long time. In the field of tire cord fabric, the company has established long-term and stable cooperative relationships with well-known domestic and foreign tire companies such as Zhengxin Group, Zhongce Rubber, Linglong Tire, Senlinglong, JiaTong Tire, Pulin Chengshan, and Doublestar Tire.

In terms of Hong Kong stocks, as many as 22 companies submitted their initial Hong Kong IPO prospectuses last week, including well-known A-share companies such as Unisplendour Co., Ltd. and Muyuan Foodstuff Co., Ltd.

I. New Share Subscriptions This Week

Looking at the schedule, Haiyang Technology is subscribed on Tuesday (June 3rd).

According to the research report from Huajin Securities, Haiyang Technology is one of the major producers of nylon 6 series products in China, with a relatively rich product system and many products with production and sales volumes in the forefront of the industry. The company was established in the 1970s and has been adhering to a diversified development strategy with nylon 6 materials as the main line for 50 years. It has now formed a complete nylon 6 product system, including chips, filaments, and cord fabrics, becoming a domestic nylon 6 industry with a relatively rich product system and a leading market position for all major products in the industry.

Specifically, in the nylon 6 chip field, the company has entered the list of qualified suppliers of large domestic and international chemical companies such as BASF, Envalior, Hyosung Group, Kingfa Science & Technology, Huading Shares, and Aifeier, and has been supplying goods for a long time; according to the prospectus, from 2022 to 2024, the company's domestic market share of nylon 6 chip production has been stable at 5%-6%.

In the field of tire cord fabric, the company has established long-term and stable cooperative relationships with well-known tire companies at home and abroad, such as Cheng Shin Group, Zhongce Rubber, Linglong Tire, Senma Rubber, Giti Tire, Pulin Chengshan, and Doublestar Tire; according to the \China Rubber Industry Yearbook\ published by the China Rubber Industry Association, the company's domestic market share of nylon tire cord fabric in 2022 and 2023 was 12.72% and 15.71%, respectively, with the relevant production ranking third in the nylon tire cord fabric industry and second in the nylon 6 tire cord fabric industry.

At the same time, Haiyang Technology continues to develop horizontally and vertically in the nylon 6 related industries; during the reporting period, the newly expanded polyester cord fabric products have become the main contribution to the company's growth. In addition, in recent years, benefiting from the vigorous development of new energy vehicles at home and abroad, the demand for semi-steel tires suitable for passenger cars has increased, thereby driving the demand for upstream supporting polyester cord fabric to grow. Polyester cord fabric products have become the main contribution to the company's growth, with revenue significantly increasing from 219 million yuan in 2022 to 714 million yuan in 2024.

Based on the similarity of business, Huajin Securities selects Juhe Shun, Hengshen New Materials, Hailide, Hengtian Hailong, Taihua New Materials, and Huading Shares as comparable listed companies to Haiyang Technology. Looking at the above-mentioned comparable companies, the average revenue scale for the comparable companies in 2024 is 5.337 billion yuan, the average PE-TTM is 11.17X, and the sales gross margin is 14.76%; in comparison, the company's revenue scale is in the mid-to-high range of the industry, while the sales gross margin is below the average of comparable companies.

II. Returns on New Shares Last Week

According to the schedule, there are no new stocks listed this week. Last week, there was a total of 1 new stock listed, which is Anhui Guqi Cashmere Material Co., Ltd. (hereinafter referred to as \Guqi Cashmere Material\, 001390).

On May 29th, Gu Qi Rong Cai was officially listed on the main board of Shenzhen Stock Exchange (hereinafter referred to as \SZSE\) with an issue price of 12.08 yuan per share. By the end of the first trading day, the stock closed at 32 yuan per share, a gain of 164.9%. Based on the closing price, investors who won one lottery ticket made a profit of 9960 yuan.

Three, last weekA-share IPO review meeting

In terms of review by the Listing Committee, Shenzhen Stock Exchange (hereinafter referred to as \SZSE\) and Beijing Stock Exchange (hereinafter referred to as \BSE\) held a new session of the Listing Review Committee meeting last week.

In this context, Hai'an Rubber Group Co., Ltd. (hereinafter referred to as \Hai'an Rubber\), which plans to go public on the Shenzhen Stock Exchange, as well as Zhejiang Zhigao Machinery Co., Ltd. (hereinafter referred to as \Zhigao Machinery\) and Hebei Shi Chang Auto Parts Co., Ltd. (hereinafter referred to as \Shi Chang Shares\), which plan to go public on the Beijing Stock Exchange, have all successfully passed the review.

Hai'an Rubber's main business includes the research and development, production, and sales of giant all-steel engineering machinery radial tires, as well as the operation and management of mining tires. Giant all-steel engineering machinery radial tires are highly distinctive high-end products in the engineering machinery tire category, characterized by their large size and mass (the largest tire has an outer diameter of over 4 meters, with a maximum mass approaching 6 tons), harsh working conditions, and long continuous working times. Therefore, the production technology of all-steel giant tires is challenging, and currently, only a few tire manufacturing enterprises are capable of achieving large-scale mass production.

The company's full-steel giant tire products are characterized by strong reliability, good consistency, and high cost-performance ratio. Relying on comprehensive advantages such as rapid response, continuous improvement, timely delivery, and precise customization, it has gradually broken the monopoly of the domestic full-steel giant tire market by the three major international brands, achieved import substitution, and promoted the localization process of full-steel giant tires. This is of great significance for ensuring and enhancing the security of China's mining supply chain.

Zhigao Machinery is a high-tech enterprise that provides professional comprehensive solutions for rock drilling engineering and air power for downstream customers, focusing on providing energy-saving, environmentally friendly, safe, and efficient drilling rigs and screw machine products. The main products are \Zhigao Tunneling,\ \ZEGA\ series drilling rigs, screw machines, and related accessories, which are widely used in fields such as mining, engineering construction, equipment manufacturing, petrochemicals, textiles and clothing, food and beverages, and pharmaceutical production. The company was recognized as a fourth batch of national-level \Little Giant\ enterprises by the Ministry of Industry and Information Technology in September 2022.

Shichang Shares is a professional company engaged in the research and development, production, and sales of automotive fuel systems, with the main products being automotive plastic fuel tank assemblies, which are widely used in many popular models of well-known vehicle manufacturers such as Geely, Chery, FAW, Changan, Jiangling, and Foton. The company's business scope includes the manufacturing and sales of automotive parts, other plastic products, pressure vessels, technological development, technical consultation, technical services, technology transfer, mold processing and sales, rental of owned workshops, general cargo warehousing services, and import and export of goods.

In terms of review by the Listing Committee, this week the Shanghai Stock Exchange (hereinafter referred to as \SSE\) will continue to conduct reviews.

The official website information shows that the Listing Review Committee of the Shanghai Stock Exchange is scheduled to hold the 18th Listing Review Committee meeting of 2025 on June 6, 2025. The meeting will review the initial public offering of Jiangyin Huaxin Precision Technology Co., Ltd. (Huaxin Jingke).

Since its establishment, Huaxin Jingke has been dedicated to the research and development, production, and sales of products in the precision stamping field. The company's main products are various precision stamping cores and precision stamping molds related to core production. Among them, precision stamping cores are the company's main products, which can be divided into various types such as new energy vehicle drive motor cores, micro and special motor cores, electrical equipment cores, ignition coil cores, etc., mainly supplied to a large number of domestic and foreign large-scale automotive parts manufacturers, motor manufacturers, electrical equipment manufacturers, and automotive manufacturers.

At the same time, the company also provides customers with precision stamping dies required for the production of core products. After years of development, the company has become one of the mainstream suppliers of core products for new energy vehicle drive motors, micro and special motors, electrical equipment, ignition coils, and other products both domestically and internationally. It has gained widespread recognition from many large domestic and foreign auto parts manufacturers, vehicle manufacturers, motor manufacturers, electrical equipment manufacturers, etc., and has established good cooperative relationships with well-known enterprises such as Valeo, Delta Electronics, Bosch Group, ElringKlinger Group, Inovance Technology, BYD, BMW, and ZF.

IV. Latest developments in Hong Kong stocks

Wind data shows that Xin Qi An (02573.HK), Rong Da Technology (09881.HK), and METALIGHT (02605.HK) will all continue to accept subscriptions from this Tuesday to Thursday (June 3rd to June 5th).

Last week, a total of 24 companies in the Hong Kong stock market submitted their prospectuses.

Among them, Yunnan Jinxun Resources Co., Ltd., JHWT Microelectronics Co., Ltd., Sheng Tong Special Medical (Qingdao) Nutrition Health Technology Co., Ltd., Shenzhen LeDong Robot Co., Ltd., Shenzhen Han's Laser & Equipment Co., Ltd., Beijing ESWIN Computing Technology Co., Ltd., SuiShouBo Group Company, Unigroup Co., Ltd., Shanghai Linqingxuan Biotechnology Co., Ltd., Jiangsu Riyu Photovoltaic New Materials Co., Ltd., Ganzhou HeMei Pharmaceutical Co., Ltd., Yuse Technology (Beijing) Co., Ltd., Beijing DeepRide Intelligence Co., Ltd., Zhejiang Liji Storage Technology Co., Ltd., Shanghai Kaiqu E-Commerce Co., Ltd., Shenzhen Basic Semiconductor Co., Ltd., Shenzhen Feisun Innovation Technology Co., Ltd., Shanghai XianGong Intelligent Technology Co., Ltd., Muyuan Foodstuff Co., Ltd., HuanShi International Logistics Holdings Co., Ltd., Shanghai Top Precision CNC Technology Co., Ltd., and Beijing Xiantong International Pharmaceutical Technology Co., Ltd. are 22 companies that have submitted for the first time.

Beijing May 1st Vision Digital Twin Technology Co., Ltd., Wuhan Dazhong Dental Medical Co., Ltd. and 2 others for updating the prospectus.

At the same time, the applications of Shenzhen Xipu Ni Precision Technology Co., Ltd., Nanjing Weizhi Zhibo Biotechnology Co., Ltd., Huizhi Holdings Co., Ltd., Changfeng Pharmaceutical Co., Ltd., Shanghai Cell Therapy Group Co., Ltd., Shanghai Zhida Technology Development Co., Ltd., Hansaitai Biopharmaceutical Technology (Wuhan) Co., Ltd., and Xuan Zhu Biotechnology Co., Ltd., totaling 8 companies, have become invalid.

Five, Records of Major Financing and Investment Events

1. On May 26th, Juyuan Biology officially completed a financing round exceeding 100 million yuan, with this round of financing jointly invested by State Investment and Yuexiu Industrial Fund. The financing funds will help Juyuan Biology to strengthen its strategic layout in the field of synthetic biology, comprehensively enhancing its overall competitiveness as a global leading synthetic biology functional protein \smart manufacturing platform\. Juyuan Biology has been deeply involved in recombinant collagen for over twenty years, and has established a full industry chain platform including gene design, strain construction, industrialization design, ton-level capacity amplification, downstream application research and development, and downstream product safety and efficacy testing. It is the only enterprise in the industry that has achieved full-chain services from sequence design to product customization.

2. On May 26th, the domestic intelligent robotics company Suzhou Lexiang Intelligent Technology Co., Ltd. (hereinafter referred to as \Lexiang Technology\) officially announced the completion of a hundred million yuan angel+ round of financing, led by Jin Qiu Fund, with old shareholders Jingwei Venture Capital, Oasis Capital, and Monolith over-investing, and Light Source Capital following the investment, with Light Source Capital serving as the exclusive financial advisor. This is the second round of financing completed by Lexiang Technology within three months, with the total amount of angel round financing nearing 300 million yuan.

3. On May 27th, Chonglian Technology, a leading enterprise in the field of digital dentistry, announced the successful completion of nearly 200 million yuan in Series B+ financing. This round of financing was jointly led by well-known investment institutions Fortuna Capital and Gaotongjia Investment. As of the completion of this round of financing, Chonglian Technology's total financing amount has exceeded 500 million yuan. Established in 2017, Chonglian Technology focuses on the full process of digitalization in denture production, and has successively developed denture intelligent design software and typesetting software, dental-specific 3D printers, and post-processing equipment with independent intellectual property rights, achieving digitalization of the entire dental industry chain.

On May 27th, Chuang Sheng Semiconductor (Shenzhen) Co., Ltd. (hereinafter referred to as \CS Semiconductor\), a high-end automotive communication chip company, completed nearly 100 million yuan in angel and angel+ round financing, with investors including Hua Ye Tian Cheng, Raising Strategic Investment, iFLYTEK Ventures, and Guo Yuan Innovation Investment. Established in 2023, CS Semiconductor is positioned in the mid-to-high-end automotive communication chip market.

5. On May 28th, Geno迈 Bio announced the completion of a 280 million yuan C+ round of financing. This round of financing was jointly led by Sheng湘 Bio, King域 Medical, Sheng Wei Rong Quan, and Jin He Capital, with the participation of institutions such as Wo Jie Capital, Haikou Jun Xin, Shuang Ye Venture Capital, and Qian He Capital. Geno迈 Bio focuses on technological innovation in gene sequencers and life omics instruments, possessing an independent intellectual property rights \SURFSeq\ sequencing technology system, and has launched a series of self-developed gene sequencers including GenoCare 1600, FASTASeq 300, GenoLab M, SURFSeq 5000, and SURFSeq Q, constructing a product array layout covering low/medium/high/ultra-high throughput.

6. On May 28th, Horizon Robotics - W (09660.HK) announced that its subsidiary, Digua Robot, has completed a Series A financing round of $100 million. This round of financing has attracted the favor of numerous domestic and international investment institutions, with joint participation from investment institutions such as Hillhouse Ventures, Five Sources Capital, Linear Capital, HeXuan Capital, JiuHe Ventures, Vertex Growth, Lishi Capital, Dunhong Assets, Boiling Point Capital, Meihua Venture Capital, and Huangpu River Capital.

7. On May 28th, Suzhou Polymateria New Material Technology Co., Ltd. (hereinafter referred to as \Polymateria New Material\) completed its Series B financing round, raising over 200 million yuan. The round was led by Luzhou Aofa Group and Zhilai Investment, with several strategic investors following suit, and existing shareholders Jinsha River United, Oasis Capital, and Zhongxin Innovation further increasing their holdings. The funds raised in this round will be used to accelerate the development of 3D printing mass manufacturing technology, the construction of factories, and the exploration of AI technology applications in the 3D printing industry.

8. On May 28th, the embodied intelligence company UniX AI completed a series of angel and angel+ rounds of financing totaling hundreds of millions of yuan, with participation from Zhongguancun Frontier Fund, Sina Capital, and Chang'an Private Capital. This round of financing will be used to accelerate the development of multimodal embodied intelligence large models and the synchronous evolution of general robot bodies, as well as to facilitate the landing and delivery in various commercial services and C-end scenarios.

9. In May 2025, Liaoning Guorui New Materials Co., Ltd. (hereinafter referred to as \Guorui New Materials\) announced the completion of hundreds of millions of yuan in Series B financing. This round of financing was jointly invested by Shenzhen Venture Capital, Hua Ying Capital, Guotai Junan Innovation Investment, Zhongxing Capital, Zhongtian Liaoning Chuang, Dehong Capital, Shenzhen Zhicheng Industrial Investment, and Wutong Tree Capital. The funds from this round of financing will be focused on the expansion of isostatically pressed graphite production capacity, the research and development of silicon carbide supporting materials, and the technological breakthroughs in the field of high-temperature gas-cooled reactors.

10. On May 29th, the global intelligent short-distance transportation company, TanTu Technology, completed a Series B financing round of hundreds of millions of yuan, with the investment made by Chase Venture Capital. TanTu Technology, established in October 2020, is a global innovative technology company focusing on intelligent short-distance travel scenarios, and has already expanded into categories such as electric scooters and golf bag cars.

11. On May 30th, Beijing ShunJing Biomedical Technology Co., Ltd. (hereinafter referred to as \ShunJing Medicine\) announced the completion of a 300 million yuan Series A financing round, which was jointly funded by Songhe Fund, Dacheng Fund, Chuangjing Kangrun, Chuangjing Shunze, Lishui QiaoDa, and Rejing Bio. The funds will be mainly used to accelerate the Phase II clinical trial of ShunJing Medicine's world-first acute myocardial infarction antibody drug SGC001 and the IND application and clinical research of other core pipelines.

12. On May 30th, Yan Huang Guo Xin announced that the company has successfully completed a B+ round of financing exceeding 100 million yuan. This round of financing was co-led by Chizhou Industrial Investment and Meihua Venture Capital. Through the \iron triangle\ system of circuit design - layout optimization - process control constructed by the company, the development cycle of space-grade DC/DC chips has been significantly shortened to 6-8 months, and the cost has been greatly reduced compared to imported products.