Tranalysis

"Outreach and Risk: Why and how do e-commerce cross borders?"It was mentioned that the cross-border e-commerce chain is long and the industrial ecology accommodates many roles. On the supply side, manufacturers and merchants (in many cases, manufacturers are merchants), service providers and platforms work together to sell China's goods; on the demand side, a large number of overseas consumers have set off a "social entertainment-style" purchase boom through the platform; on the regulatory side, domestic and foreign governments regulate and restrict the industry through policies such as tariffs and business integrity.

At present, the cross-border e-commerce supply side is facing a "reshuffle": manufacturers and merchants are stuck at low prices and are difficult to open up the market for brands to go abroad; service providers face the problem of insufficient overall experience and mixed industries. In the future, more and more market shares will be reserved for professional, compliant and players who have stepped out of homogeneous and low-cost competition.

Manufacturer: Become at low prices, fall into low prices

"Blue Ocean" has become "Red Sea", why have cross-border e-commerce profits weakened?

Since 2024, the cross-border e-commerce dividends have cooled significantly. The CEO of a trading company in Ningbo City said that cross-border e-commerce has fallen into low prices, and sinking the market is still the norm for going to sea in 2024. "Cross-border e-commerce dividends have further disappeared, making it more difficult for new sellers to operate and lower profit margins."

According to Hugo cross-border data, in 2023, only 27% of sellers said that profits were higher than the same period last year, 14% of sellers said profits were the same as the same period last year, and 59% of sellers said profits fell. In the first quarter of 2024, 12% of sellers said profits were flat from the same period last year, while another 44% of sellers saw profits falling year-on-year. At the same time, nearly 70% of sellers 'costs increased year-on-year, and 50% of sellers' year-end peak season performance fell short of expectations.

The gradual decline in cross-border e-commerce profits is first related to the surge in the number of merchants. According to enterprise survey data, as of September 25, 2024, there are currently 74780 enterprises that include "cross-border e-commerce" in China's industrial and commercial information, of which 61.8% were established in the past three years (2021.9-2024.9), and 65.7% are small and micro enterprises. The number of cross-border e-commerce companies has begun to increase rapidly in 2020, and the proportion of companies that cancel each year has decreased year by year. It can be seen that cross-border e-commerce is still in the stage of influx of companies.

Yu Zhonghua, chief of the E-commerce Section of the Market Development Committee of Yiwu City, told the Paper Research Institute that the increase in the number of merchants is related to the current high employment pressure in other industries, while cross-border e-commerce has low entry barriers and good prospects. In recent years, a large number of young people have flocked to Yiwu to learn how to operate cross-border e-commerce."You can come and sign up for a training class, or work with a boss for a period of time, and you will be able to get started soon." In order to further supplement cross-border talents, Yiwu also launched the "Cross-border e-commerce training action for tens of thousands of people”。According to data from the Yiwu City Market Development Committee, in the first half of this year, Yiwu's e-commerce entities reached 654,600, 40% of which were engaged in cross-border e-commerce business.

In addition to the increase in the number of merchants, the decline in profits is also affected by the homogenization of goods. According to the International Trade and Economic Cooperation Research of the Ministry of CommercereportIndustries represented by textiles, light industry, shoes and bags, etc."have problems such as overcapacity for low-end products, single variety structure, low-level duplication of construction, and insufficient innovation motivation." This type of product is the main source of cross-border e-commerce. According to China customs data, cross-border e-commerce exports in 2023 will mainly include various digital products and accessories such as clothing, shoes, bags and jewelry accessories, home textiles and kitchen appliances, mobile phones, and household office appliances and accessories.

Another piece of evidence about the relationship between "China cross-border e-commerce" and "cheap homogeneous products" comes from overseas research. British market consulting firm Omnisend recently conducted a poll of 4000 people from the United States, the United Kingdom, Canada and Australia, and found that the products they mainly purchased on China e-commerce platforms such as Temu and Shein are clothing, shoes and bags, household products, electronic 3Cs and accessories and beauty; and a total of 82% of respondents said that the main reasons for shopping on e-commerce in China are "cheap" and "discounts."

At the same time, export goods mainly come from Guangdong, Zhejiang, Fujian and Jiangsu, which are also the main gathering places for the "cross-border e-commerce + industrial belt" strategy. In other words, the sources of goods from different merchants are likely to be similar or identical factories. "Especially general goods (ordinary goods that have no special requirements for transportation, loading and unloading, and storage)," a Yiwu businessman told the Paper Research Institute,"Everyone's products and shipping routes will not differ much." Moreover,"the profits of general goods are generally very low, and there will always be someone who can accept lower profits than you to get more natural traffic on the platform.(At this time) you have to lower the price."

The price comparison function often found on e-commerce platforms makes the price competition of homogeneous goods more intense. A Yiwu merchant told a researcher at the Paper Research Institute that the platform system will automatically recommend lower-priced similar products when consumers stay on the page and check out. In addition, platforms have been competing to launch a "full hosting" model this year, that is, after merchants upload products, the platform will measure the situation of similar products across the network and provide a reference price for the products. These technologies all allow price information to be quickly "aligned" between different merchants and consumers.

Finally, the decline in cross-border e-commerce profits is also affected by overseas consumption dynamics. For example, most merchants reported that the global economy was recovering slowly, and the sales effect of the 2023 "Black Friday" shopping festival fell short of expectations. At the same time, the European and American consumer markets recovered to weakness, resulting in a period of continued low inventory clearance in the first half of 2024.

Profits of "general goods" will continue to decline until economic profits reach zero

During the "blue ocean" period of cross-border e-commerce (i.e., the epidemic period), the number of China merchants is small, and compared with overseas competitors, they can provide more favorable prices and have certain pricing power. A merchant selling curtains through a cross-border e-commerce platform told a researcher at the Paper Institute: "Custom curtains in the United States are very expensive. A house costs US$30,000 (about 200,000 RMB), but it only costs more than 200,000 RMB to buy from the platform. Then if I sell it on Amazon, I'll sell it for $15,000, okay? In such a big market, just eating a little is enough for me to earn." This is a typical thinking of "getting up early to make a difference", but this "difference" cannot last long.

With the "semi-custody/full-custody", the going of China's e-commerce platforms, the popularization of the "one-piece delivery" model, and the improvement of the construction of "overseas warehouses" and other facilities, the threshold for entering cross-border e-commerce has been lowered, attracting more and more China merchants to settle in;"latecomers" sell similar products but bid lower, resulting in overseas prices getting closer to those of China's supply chain. As Fan Yu, general manager of Xihu (Shanghai) Industrial Co., Ltd., commented: "An important criterion for doing cross-border e-commerce is to choose a track with few people in China; once China people come in, they will soon lose money."

According to economic theory, cross-border e-commerce is very close to a "completely competitive market" ecosystem. In a perfectly competitive market: ① There are many buyers and sellers in the market;② The goods provided by each seller are roughly the same;③ Enterprises are free to enter or exit the market. In the long run, commodity prices in a perfectly competitive market will reach equilibrium when they are equal to the average total cost, when the enterprise's economic profit will be zero. Among them, economic profits include accounting profits and hidden costs (or opportunity costs, which refer to other possibilities that merchants give up in order to engage in cross-border e-commerce).

In other words, the profit margin of the industry will continue to decrease until the accounting benefits of doing cross-border e-commerce with the same investment are similar to those of doing other industries. As more and more companies enter, it is normal for profits to decline, and profit margins may continue to decrease to similar to domestic trade. By then, the scale of the cross-border e-commerce market will stabilize.

At present, the cross-border e-commerce export market is still gradually moving towards long-term equilibrium. Although the profit margin has decreased, it still has advantages compared to domestic trade. As for when the final equilibrium point will arrive and where the accounting profits at the equilibrium point will stop, many factors are still at play.

There are internal factors, such as the speed at which the cross-border e-commerce market becomes fully competitive (this depends in part on the advancement of technology, knowledge, and infrastructure in the industry); changes in the economic environment of China and the return on general production inputs in other industries (which determines the level of explicit and implicit costs); the maturity of some business models (immature business models have greater risks and bring transaction costs, such as some previous onesfreight forwarding companyIllegal customs declaration of goods received at low prices, and high fines were imposed after being investigated and punished, resulting in the break of the capital chain and escape).

There are also external factors that are constantly squeezing the living space of the "low-price" model. For example, since 2024, the United States, Brazil, the European Union and other regions have adjusted tariff policies due to the development of cross-border e-commerce in China. September 13, 2024, the Biden administration of the United StatesannouncedThe tariff exemption measures for small goods will be adjusted (previously exempt from taxes on packages under US$800). On August 1, 2024, the Brazilian federal government's new tax reform regulationsentry into force, a 20% tariff will be imposed on imported goods worth US$50 and less per piece (previously, packages under US$50 were exempt from tax). At the same time, there is news that the EU plans to purchase goods worth less than 150 euros from e-commerce platforms outside the EUimpose import tariffsto curb the surge in cheap imports from cross-border e-commerce from China.

In overseas narratives, the revision of tariffs is to "close for tax loopholes": China's e-commerce platforms often understate the value of goods, while customs cannot inspect all packages, resulting in a large amount of tax losses; this phenomenon has caused dissatisfaction among local e-commerce and local fast fashion brands, arguing that this "exacerbates unfair competition." however, some scholarsthinkThis is a form of trade protectionism. But in any case, this is a trend to curb "low-price" strategies, that is, overseas countries cannot sit back and watch as low-priced packages from China flood their local markets.

It is not easy to get out of low prices and build brands, and cross-border adds more complexity.

Amid the above profit pressure, although some merchants still position cross-border e-commerce as a business with small profits and quick turnover, more people arediscussedHow to use e-commerce channels to get rid of low prices and establish a brand. "The end of e-commerce going abroad should not be the extreme low price, but the brand going abroad."

For merchants, to move out of a completely competitive market, they must become a minority of suppliers of differentiated goods, and other merchants cannot easily imitate them. You can try to increase investment in brand building or try to sell products with more intellectual property rights. However, making the above two attempts on e-commerce platforms has encountered some challenges.

First, the online sales model pays more attention to visual marketing and existing reviews, so the advantages of new products that cannot be reflected visually are difficult to effectively pass on to consumers. Many merchants complained to researchers at the Paper Research Institute that the Internet is suitable for selling products that are "good-looking but can make do with", but not suitable for selling products that are "durable but not visible to be durable". Therefore, it is a difficult way to increase prices by improving product quality rather than design. "What I use is better materials, but consumers can't touch them. Just looking at the pictures, they are similar to those of inferior materials. I also invested a lot of traffic, but in the end, the price comparison was cut by other merchants." In order to reflect the material advantages of the product, the merchant had to increase marketing costs-taking new photos and videos, adding several live commentaries, purchasing "out-of-box tests" for Internet celebrities, setting up more favorable reviews. Reward, and so on.

Second, it is not easy to protect intellectual property rights on e-commerce platforms, especially the general goods mentioned above that emphasize design. Taking clothing and jewelry, where plagiarism is serious, as an example, it is not only a very challenging task to legally prove the uniqueness of designs and evidence collection of plagiarism, but most small and medium-sized businesses also do not have the financial resources and energy to apply for patents and pursue plagiarism.

Some merchants even choose not to sell online in order to protect intellectual property rights and brand value. The promoter of a brand that makes Buddhist cultural jewelry in Yiwu Commodity City deliberately avoided using cross-border e-commerce platforms and retained the traditional offline import and export trade method. "The advantages of my product are mainly reflected in the design and feel," she told The Paper Institute."But once a picture is taken and posted online, not only will customers not be able to feel the texture of a real gem, but they will soon have the same design but worse materials. Products appear."

For cross-border e-commerce, online intellectual property protection adds more complexity-trends in product design and efforts to combat intellectual property infringement vary among different platforms and countries. For example, on European and American e-commerce platforms, intellectual property protection is greater and there are more rewards for innovative design; while domestic investment and e-commerce platforms in Asia, Africa and Latin America are often more tolerant of similar products (China's State Administration of Market Regulation is taking measures to increase awareness of intellectual property protection on various platforms, but the specific results remain to be seen).

Third, merchants from Yiwu and Hangzhou told researchers at the Paper Institute that selling at high prices overseas requires competition with local brands. Local brands often have offline stores, and local marketing is also better. Most of China's products are "unfamiliar with the place" and it is difficult to "open up the situation." In addition, obtaining consumer preferences in overseas markets is also a difficult matter for small and medium-sized manufacturers. A European furniture e-commerce manufacturer in Hangzhou told a researcher at the Paper Research Institute: "How do I know what sofas they like? I have never been to Europe. After thinking about it, our comparative advantage is really only price advantage."

Fourth, China e-commerce brands, which are currently booming overseas, have further established the stereotype of "first-class prices, second-rate quality and service" overseas, which makes it more difficult for China manufacturers to create a "high-quality and tasteful" brand effect.

Consumer complaints involving cross-border e-commerce in China focus on returns, logistics and user services, and there are also more and more comments that China's low-priced small commodities are "not very durable." However, low prices and beautiful pictures still attract more and more overseas consumers to place orders. Omnisend in a survey involving 4000 peopleinvestigationIt was found that although only 6.4% of respondents expressed trust in China e-commerce brands, 48% of respondents often shop on China e-commerce.

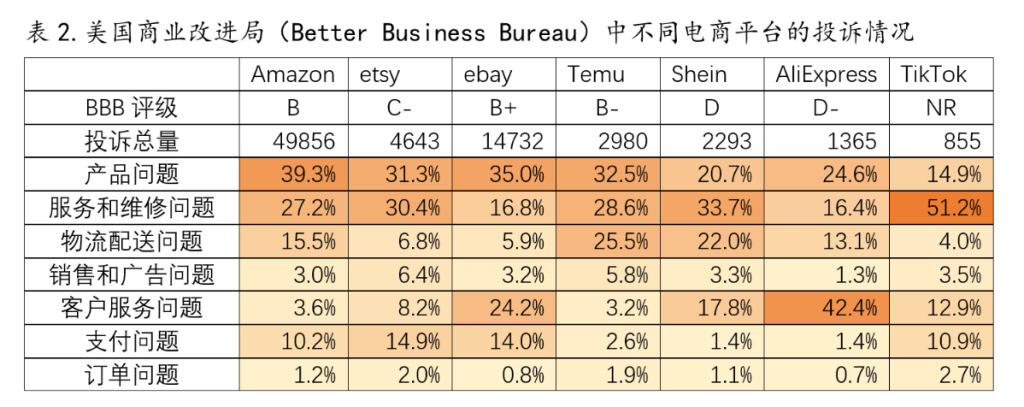

British market consulting firm rated SHEIN, Temu and AliExpress as D, B-and D-respectively on the Better Business Bureau rating; for reference, American e-commerce Amazon and Ebay have achieved B and B+. This shows that in the European and American business evaluation guidelines, there is still much room for improvement in the "commercial reliability" of China e-commerce

Service Providers: Rising transaction costs

The professionalism of cross-border e-commerce has increased, resulting in a large number of knowledge gaps

The entry threshold for cross-border e-commerce continues to drop, but it is becoming increasingly difficult not to make "leeks". Many merchants have slowly discovered that to be proficient in cross-border e-commerce, in addition to understanding knowledge of the product itself, they also need to understand certain legal, technical and overseas social and economic knowledge. Compared with domestic e-commerce companies that have become mature and stable, cross-border e-commerce has greater and more urgent needs for this knowledge. But for most small and micro businesses, smoothing these knowledge gaps is not easy.

In terms of technology, operating e-commerce requires mastering the latest digital skills-be able to shoot videos, write scripts, and attract traffic; be able to capture data; and be able to use AI. A novice businessman in Yiwu told The Paper Institute: "In the past, shipments could be shipped based on the natural traffic of the platform. Now we need to shoot eye-catching small theaters, and the creative costs and requirements have increased." There are also many novice merchants who are learning how to create AI anchors, AI customer service, AI graph video editing and automated data analysis.

For cross-border businesses, digital marketing becomes even more urgent. While many domestic e-commerce companies can still "do things in traditional ways," many cross-border merchants have to use AI drawing and online translation to produce promotional materials for overseas markets. For example, they need to change the original picture of a China model to an American model; translate Chinese promotional words into English.

In terms of compliance, the platform rules are complex and changeable, including changes in violations and penalties such as prohibited sales of restricted goods, operation comments, and related accounts. There are many different brands of e-commerce platforms in the cross-border e-commerce field, and the operating rules of different platforms are different. Even for the same platform, its rules often change.

In particular, overseas regulatory policies have been tightened since 2024, and many platforms, including Amazon, have increased compliance requirements for store audits. "The rules of the platform are complex and changeable, and violations will occur if you are not careful; some platforms do not remind them and impose fines afterwards, and it takes ten days and a half a month to appeal." Research by the Paper Research Institute found that many e-commerce companies often learn the huge and complex rule systems and "traffic passwords" of different platforms in advance before starting a store.

In addition, there are many trademark property disputes. China's property rights environment is relatively "loose". Many small, medium and even large manufacturers do not have a strong legal awareness of trademarks and intellectual property rights. They even deliberately imitate the designs of "big names" and ride on the popularity of "big names." Small and medium-sized enterprises often have insufficient legal knowledge and do not have the budget to hire lawyers. Therefore, a lot of experience is "gained through stepping on a hole." When researchers from the Paper Research Institute were "selecting" products in Yiwu Trade City, many merchants reminded that some sensitive products could not be sold on a certain platform or country, which "would cause trouble."

When Mr. Chen, founder of an e-commerce organization in Yiwu, was cooperating with an e-commerce platform to attract investment, he was sued by the latter for trademark infringement because he used the e-commerce platform's trademark to attract customers. President Chen was very confused: "I help (this platform) attract investment, so I will definitely mention its name. Isn't this helping him promote?" President Chen also believed,"If the platform could remind us, we would not have done so, but when they found out, they didn't remind us and directly sued me for compensation of 3 million yuan." President Chen believes that his ability in legal knowledge cannot compete with the platform and is at a disadvantage.

In terms of the market, doing a good job in cross-border e-commerce increasingly requires deep localized knowledge. To create "hot products", we need to understand local trends and "pain points", shopping nodes, customer payment capabilities, logistics conditions, etc. in overseas markets. A lot of knowledge is specific, detailed and dynamic, and cannot be copied from China's experience (especially in some fashion items, where aesthetic differences between China and foreign countries can be huge), and it cannot be easily obtained from the Chinese Internet.

The founder of a furniture brand in Hangzhou was planning to ship large-sized furniture to the UK, but soon he found himself in urgent need of knowledge about British society, life and economy, including "the local business environment and economic conditions","the age, occupation, nationality, income range","product preferences of large-sized furniture e-commerce customers","brand, product, pricing, competitive relationship","local reliable and cost-effective service providers", etc.

He believes that "European consumers are not too picky, and business will be easier than at home." However, the difficulty is to truly understand the consumer needs of the target country and then translate the needs into a language that the country can understand. "Without five years of life experience or even longer, it is difficult to truly understand consumers in a country." However, the founder has never been to the UK.

In addition, the improvement in professional requirements for cross-border e-commerce is also reflected in familiarity with financial payment risks, tax and customs clearance terms, etc. It is worth mentioning that many supporting systems involving cross-border e-commerce are still in a period of change that has not yet been fully formed. Therefore, cross-border e-commerce merchants not only need to be familiar with the rules themselves, but also need to follow up on changes in the rules from time to time.

A large number of service providers emerged, covering e-commerce needs at all levels

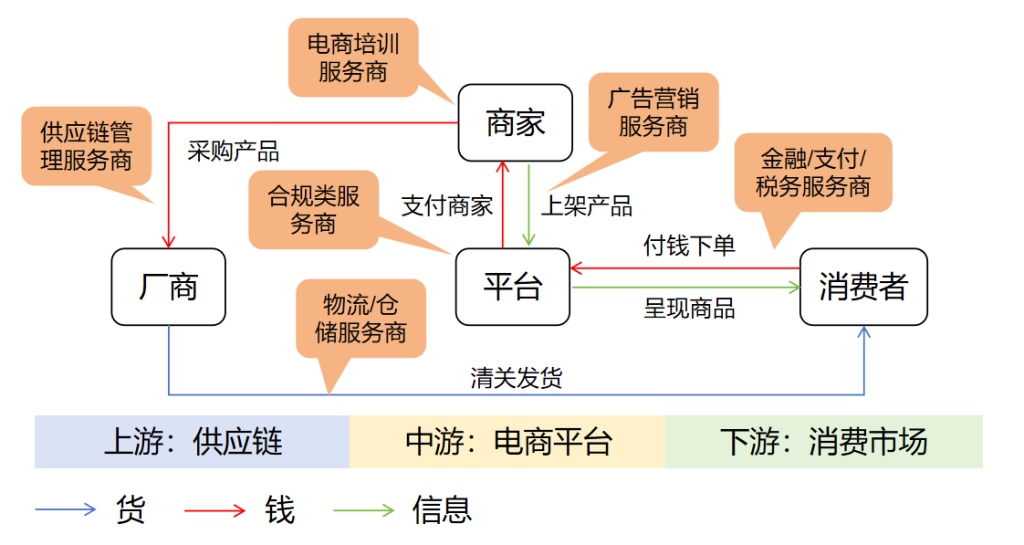

With the increasing demand for professional knowledge by cross-border e-commerce companies, various service industries have emerged. For example, in response to the above-mentioned problems, the cross-border e-commerce industry has created enterprises, self-employed households and "Internet celebrities" that provide digital services, training services, compliance services and market information services. Figure 1 systematically shows the positions of six types of important service providers in the cross-border e-commerce industry chain.

Figure 1. The positions of six types of important service providers in the cross-border e-commerce industry chain (drawing by Xie Qiuyi)

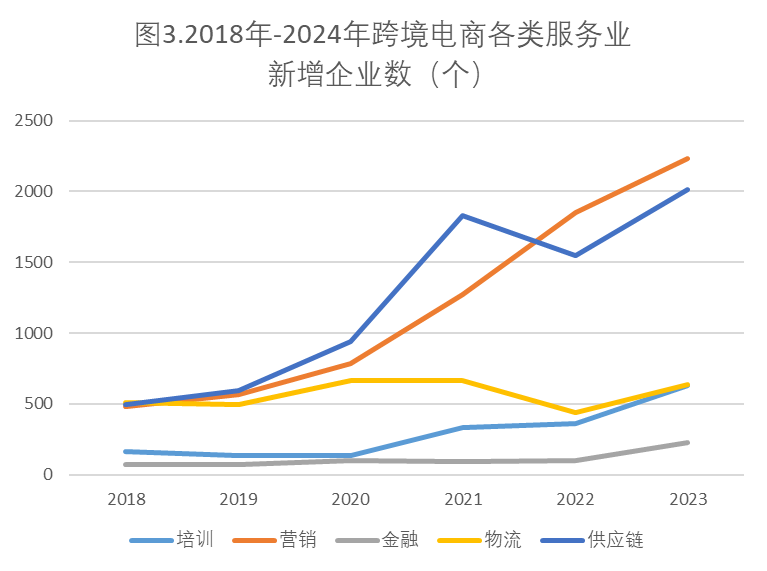

Cross-border e-commerce service companies will usher in a growth peak in 2023. According to enterprise survey data, 42.80% of the 17345 cross-border e-commerce service companies currently operating normally were established after 2023 [1]. Looking back at historical data (Figure 2), cross-border e-commerce service companies have experienced significant growth during the epidemic, with a slight decline in 2022.

Data source: Enterprise Check Xie Qiuyi Cartography

The main body of the cross-border e-commerce service industry is small and micro enterprises, which is consistent with the situation of the e-commerce entities it serves. Among the cross-border e-commerce service companies that are still registered as normal operating [2], 77.1% are micro enterprises, 20.27% are small enterprises, 2.53% are medium-sized enterprises, and 0.10% are large enterprises. In contrast, among all cross-border e-commerce companies that are still registered as operating normally, 69.61% are micro enterprises, 23.61% are small enterprises, 5.77% are medium-sized enterprises, and 1.02% are large enterprises.

Taking a closer look at the different types of cross-border e-commerce service industries [3], among the companies currently specializing in cross-border e-commerce financial/payment/tax reporting services in the country, 44.82% were established after 2023, and another 40.83%, 40.01%, 36.45% and 22.00% of cross-border e-commerce training companies, advertising marketing companies, Supply chain service companies and logistics and transportation companies will be established after 2023 (2023-01-01 to 2024-09-30)[4].

Compared with various service industries, financial payment companies have the fastest growth rate. The number of new companies in 2023 will increase by 131.63% compared with 2022 (Figure 3). Before 2022, the industry will maintain a low growth rate of less than 100 companies per year. Advertising and marketing companies are currently the cross-border e-commerce service industry with the largest number of companies, reaching 9402, with a growth rate of 20.76% in 2023. In addition, the growth rates of training service companies and logistics companies will reach 73.33% and 44.54% respectively in 2023.

Data source: The number of enterprises listed above only includes service enterprises established specifically for cross-border e-commerce (Xie Qiuyi's drawings)

Photo by Xie Qiuyi, small and micro enterprise advertisements for e-commerce training and marketing services that can be seen everywhere in Yiwu

Photo by Xie Qiuyi, small and micro enterprise advertisements for e-commerce training and marketing services that can be seen everywhere in Yiwu

Small and medium-sized businesses have limited payment capabilities, and service providers are mixed

Although the demand for professional services by cross-border e-commerce merchants is increasing day by day, because most merchants are small and micro enterprises or self-employed entrepreneurs, and because cross-border e-commerce has low profits, most merchants have low ability to pay for non-essential services. Strong, low willingness to pay. During a survey in Yiwu, researchers from the Paper Research Institute found that the vast majority of training and marketing services for cross-border e-commerce cost around 1,000 yuan; the fees of small and medium-sized freight forwarders are also being pressed again and again, and many merchants will choose to use online Free resources,"try not to spend money".

General Manager Chen, founder of a small and micro cross-border e-commerce training company in Yiwu, told the Paper Institute that a large number of training institutions "have just started their own business and begun to understand the entire cross-border business." Therefore, there is a process to identify problems and optimize services."It needs to grow together with cross-border e-commerce." "All industries are not easy to do now, and we are also under great pressure in terms of profits, customer satisfaction and compliance."

However, the current service quality of the cross-border e-commerce service industry is "mixed"(especially concentrated among small and micro service providers), and some even directly involve fraud.

For example, in 2024, Hubei Wuhan Public Security Bureau cracked a cross-border e-commerce agent operation fraud case. According to the latest data from Consumer Insurance, a consumer service guarantee platform under the China Electronics Chamber of Commerce, the total number of complaints about cross-border e-commerce agency operations has reached 19117, of which the number of suspected fraud cases is 2871, accounting for 15.02%.

Risk warning slogans that can be seen everywhere in Yiwu Photo by Xie Qiuyi

Another "explosion point" appears in freight forwarding. Starting from 2023, a group of freight forwarders have frequently experienced mine explosions and running away due to problems such as declining customer orders, defaulting on freight by peers, and compensation caused by the seizure of cabinets. Many freight forwarding companies received goods at low prices and declared customs in violation of regulations. After being investigated and punished, high fines led to the break of the capital chain. On September 15, 2024, the Yiwu City Cross-Border E-Commerce Association issued the "Cross-Border Logistics Industry Security Sustained Initiative", mentioning that "the recent increase in disputes involving cross-border e-commerce logistics and international freight forwarding has had a greater impact on the industry", calling on enterprises to "consider the qualifications of service providers and not blindly use low prices to measure the standards of service providers."

Researchers at the Paper Research Institute found that small and micro e-commerce companies, especially "novices", do not have a strong ability to identify excellent service providers."The advertising content is all similar, and the only thing that can be compared is the price." However, once an unreliable service provider is selected, it will cause large losses and be difficult to hold accountable, causing e-commerce merchants to become cautious when selecting service providers. In other words, the current transaction costs of the cross-border e-commerce service industry are high, which is not conducive to the development of the industry.

Cross-border e-commerce service industry has high transaction costs, and it is recommended to further regulate market order

Transaction costs refer to transaction costs that are defined as the additional costs required when exchanging products or services between two entities in addition to the costs of the products or services themselves, including search and information costs, bargaining and decision-making costs, supervision and default costs. Economist Douglass C. North) believes that systems that help reduce transaction costs can promote economic growth.

The current cross-border e-commerce service industry is mixed, which hinders the development of the industry by increasing transaction costs. First of all, the current e-commerce service industry provides similar services, but there is a lack of reference for service quality, which leads to increased search and information costs for transactions. Secondly, if small and micro enterprises fail to agree on after-sales and refund obligations in transactions, it often leads to subsequent differences, and the cost of supervision and default is high.

According to Nobel Prize winner Coase, R.H. According to the theory that if transaction costs in the service industry continue to rise, companies will tend to solve service problems within the company (such as establishing a legal department and a marketing department internally, directly hiring training experts, etc.) rather than purchasing in the market. Often only large companies have the ability to bear the increased operating costs of the business or partner with service providers with lower transaction costs (such partners generally have higher prices).

This means that the cross-border e-commerce industry has entered a reshuffle stage after experiencing early barbaric growth. The market concentration of industry-related service industries will continue to increase, and small and micro businesses lacking professional capabilities will face the risk of elimination.

Cross-border e-commerce supply side faces "reshuffle"

An important foundation for the early rapid development of the cross-border e-commerce industry is still the low-cost advantage of China products. But making "low prices" is ultimately "thankless". The competition between homogeneous products for extreme cost performance will inevitably lead to continuous reduction in profit margins and long-term "corruption" in the industry. In particular, with the full competition in the cross-border e-commerce market and the iteration of technology and business models, more and more people are participating at low costs. The profits of manufacturers and merchants continue to decline, and service providers are mixed and have constant disputes.

The phenomenal popularity of cross-border e-commerce has prompted us to reflect on whether we should "carry out low prices to the end." If Manufacturing in China wants to improve its position in the world industrial chain, it cannot rely on the old path of OEM globalization since 2001. In fact,"Made in China" has already ushered in an opportunity to shift to "China Brand". For example, in recent years, the main consumer force in the United States has become Millennials (born 1981-1996) and Generation Z (born 1996-2012); these two generations have stronger spending power and see China as a technological and commercial power. This is an important window for those who go to sea. During the survey, researchers at the Paper Research Institute found that all cross-border e-commerce companies with good operating conditions are more or less thinking about "branding overseas" and how to create premium products. However,"brand" does not automatically appear with the extreme "low price", but requires the upgrade of the entire business logic. This point is specifically discussed in the section above "It is not easy to get rid of low prices and build brands, and cross-border adds more complexity".

In addition to "do you want it", there is also "can you". There are many signs that the road to "low prices" will become increasingly difficult. One of the key factors in "low prices" is low labor costs. However, China has entered an aging society, and the demographic dividend is fading. At the same time, institutional reforms are deepening. The low prices brought by low wages, low environmental standards, and low property rights protection will last remains to be seen.

In addition, overseas countries are paying intensive attention to the commercial legitimacy of China's cross-border e-commerce platforms. Some regulations involve trade protectionism. An Indonesian government minister said he has asked Google and Apple to block apps from Temu, a cross-border e-commerce platform owned by Pinduodo, in their app stores so that they cannot be downloaded. The minister said: "We are not here to protect e-commerce, but to protect small and medium-sized enterprises. We must protect millions of businesses."

There are also regulations that involve guidelines and regulations that are consistent with local markets. On October 11, 2024, the European Union (EU) Commission asked the company to provide more information for investigation on suspicion that Temu had failed to take sufficient measures to stop the sale of illegal products. Previously, Temu was officially designated by the European Commission as a "very large online platform" under the Digital Services Act and was required to comply with stricter new operational security regulations to ensure user safety and platform responsibility.

On June 23, Friedrich Merz, chairman of Germany's largest opposition CDU, called for stricter and effective supervision of China online sales platforms such as Temu and Shein. "While European manufacturers should not have comprehensive control over their ordinary products and force them to supervise global supply chains, a large number of cheap products from Asia should be allowed to flow into the country without any tariffs or commodity inspections... Most importantly, no one checks whether these goods delivered directly to consumers meet European environmental and consumer protection standards."

At the same time, although China's e-commerce platforms use low prices as their main selling point, they still need to provide a certain degree of quality control and service guarantee to truly gain a foothold in overseas markets. According to data from the Better Business Bureau (BBB), complaints against e-commerce platforms mainly focus on product quality, followed by customer service, logistics, and return services (Table 2).

Data source: U.S. Bureau for Better Business; NR is Not Rated (Tabulated by Xie Qiuyi)

These challenges are all increasing the operating costs of the platform and squeezing profit margins. The pressure will be transmitted to merchants and related service providers by adjusting platform rules and increasing service fees.

In other words, the cross-border e-commerce supply side is facing a "reshuffle", and the early low-threshold and rough development model is affected by many factors and is constantly shrinking. In the future, the industry concentration of cross-border e-commerce will further increase, and more and more market share will be reserved for professional, compliant players, and able to get out of "low prices".

Endnotes:

[1]Refers to enterprises established from 1/1/2023 to 9/30/2024; the inquiry time is 2024/10/15; the enterprises referred to in this article refer to all industrial and commercial registered market entities including enterprises, individual industrial and commercial households, social organizations, etc.

[2]The cross-border e-commerce service enterprises included in the statistics in this article only include enterprises whose words such as "cross-border e-commerce" and "training, marketing, finance, logistics, and services" appear in the industrial and commercial registration information. Market entities that actually provide services to cross-border e-commerce companies but are not reflected in the industrial and commercial registration information, or have not registered for industrial and commercial but still provide services, are not included in the statistics. Therefore, the data used in this paper should be slightly lower than the actual situation.

[3]Because most companies that specialize in providing compliance services are concurrently appointed by law firms and do not specifically mention "cross-border e-commerce" in the industrial and commercial registration information, the results derived based on the above data search method deviate greatly from the facts, so they are not included in statistics. According to research by the Paper Research Institute, most small and medium-sized cross-border e-commerce companies are unable to pay for specialized compliance services, but generally obtain compliance information and suggestions from other services or business experience.

[4]Note above, only service industry companies targeting cross-border e-commerce are included. In terms of logistics, 2023 actually witnessed the establishment of a large number of small and medium-sized freight forwarding companies, but because they did not specifically indicate in the industrial and commercial registration information that they serve cross-border e-commerce, they were not included in the statistics.