Tranalysis

From September 19 to 20, the China-US Economic Working Group held its fifth meeting in Beijing.

Just as the China-US Economic Working Group held a meeting, the Federal Reserve announced that it would cut the target range of the federal funds rate by 50 basis points, starting the first interest rate cut in four years.

Faced with the new situation and new changes in the economic field, what important topics were discussed at this meeting of the China-US Economic Working Group, and how to understand the signals conveyed therein?

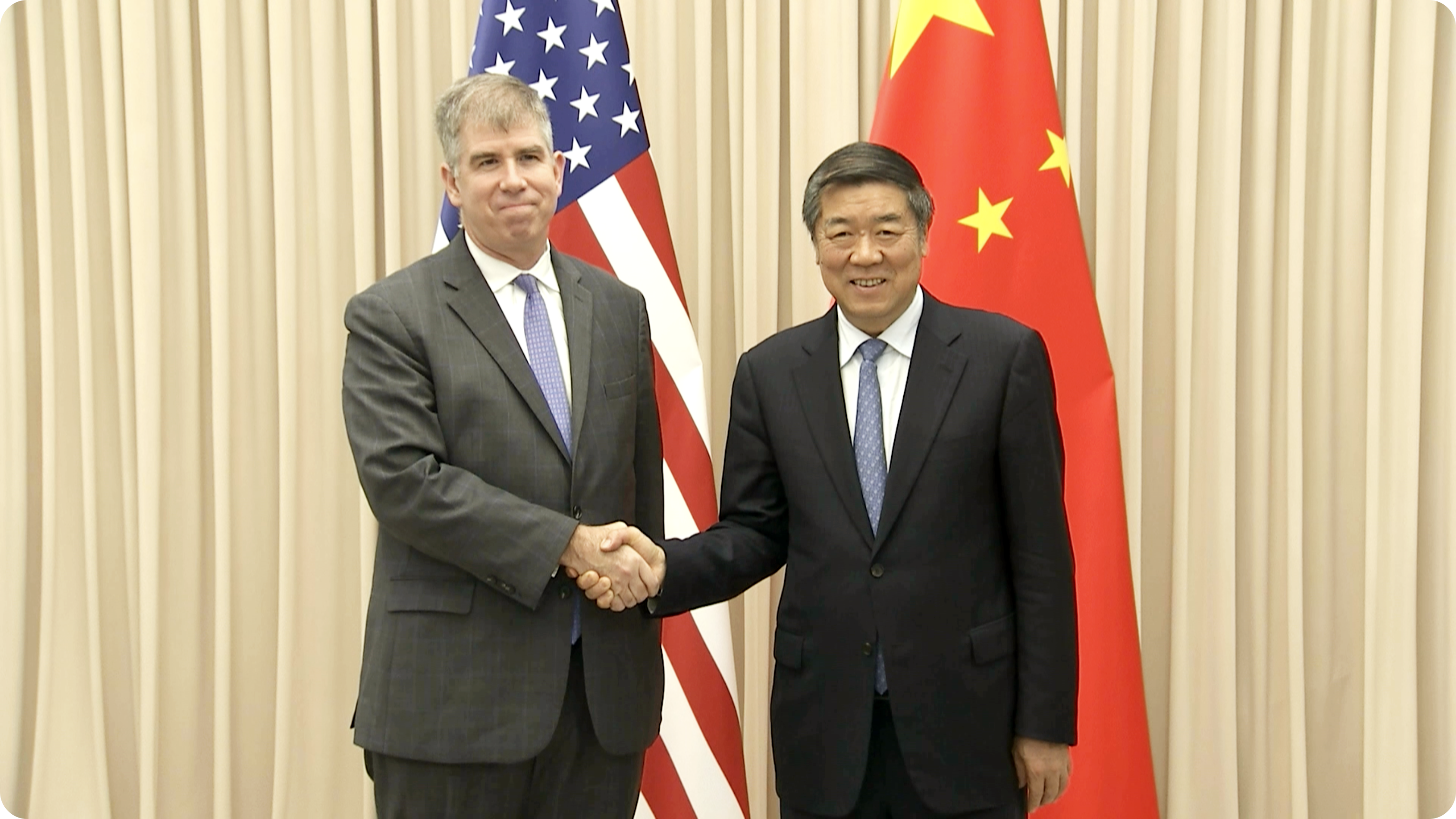

Tan master learned that this working group meeting,China was led by Vice Minister of Finance Liao Min, and officials from the Ministry of Finance, the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Commerce, and the People's Bank of China attended the meeting.

The United States is led by Deputy Treasury Secretary Shang Bo, mainly involving officials from the Ministry of Finance and the Federal Reserve.

It can be seen that basically all relevant economic departments from China and the United States attended the meeting.

Such communication has occurred five times in the past less than a year.

On September 22 last year, in order to implement the important consensus reached by the two heads of state, the leaders of China and the United States jointly promoted the establishment of the China-US Economic Working Group as a working mechanism in the economic field, and led by officials at the deputy ministerial level from the ministries of finance of the two countries.

Tan Zhu noticed that"In-depth"It is a word that is almost always mentioned in press releases at these working group meetings.

Each in-depth communication revolves around three main topics:The first is the macroeconomic situation of the two countries, the second is global economic challenges, and the third is the specific concerns of both sides.

The economic situation of China and the United States is related to the development of the two countries and the world.

This can be seen from the timing of the Economic Working Group meeting.

Before the first China-US Economic Working Group meeting, the United Nations Conference on Trade and Development issued a warning about global economic stagnation. At that meeting, China and the United States communicated on the "macroeconomic situation and policies of the two countries and the world."

This meeting is the first China-US Economic Working Group meeting held after the Third Plenary Session of the 20th CPC Central Committee. Tan learned that at the meeting, China introduced the relevant arrangements for the Third Plenary Session of the 20th CPC Central Committee on further comprehensively deepening reforms, focusing on promoting relevant reform measures to cultivate a complete domestic demand system and deepen high-level opening up to the outside world.

The economic departments of China and the United States conduct regular and frequent exchanges, which is a direct reflection of the effective implementation of the consensus reached at the San Francisco meeting between the heads of state of China and the United States. It also sends a positive signal to stabilize Sino-US economic relations.

Not long ago, when President Xi Jinping met with Sullivan, the National Security Advisor to the President of the United States, who was visiting China, he proposed "four unchanged"--China's goal of stable, healthy and sustainable development of Sino-US relations has not changed. China's principles of handling Sino-US relations in accordance with mutual respect, peaceful coexistence, and win-win cooperation have not changed. China's stance on firmly safeguarding its sovereignty, security, and development interests has not changed., its efforts to continue the traditional friendship between the Chinese and American peoples have not changed.This is China's most authoritative exposition of Sino-US relations.

Specifically at the level of economic and trade relations, He Lifeng, Vice Premier of the State Council and Chinese leader of China-US economic and trade, also met with the US delegation after the Economic Working Group meeting on September 20. He Lifeng said that China and the United States should implement the important consensus reached by the two heads of state in San Francisco and the telephone call in April this year, maintain communication and exchanges in the economic field, strengthen macroeconomic policy coordination, properly handle each other's concerns on the basis of equality and mutual respect, and promote Sino-US economic relations are developing steadily and healthily.

During the meeting, the U.S. delegation also conveyed a message from U.S. Treasury Secretary Yellen, saying that "the U.S. is willing to maintain communication with China in the economic field and develop healthy Sino-US economic relations." This in itself reflects the importance of the leaders of China and the United States on this issue. Communication channels are highly valued.

China has always been committed to stabilizing and developing Sino-US economic and trade relations on the basis of equality and mutual respect, and its rational and pragmatic attitude has remained unchanged.

During this Economic Working Group meeting, China and the United States each raised mutual concerns.

It can be seen from the US press release that the two sides discussed the issue of balanced global economic growth. In fact, the United States has long held false accusations against China on this issue.

Gao Lingyun from the Institute of World Economics and Politics of the Chinese Academy of Social Sciences told Tan Zhu: The global economic imbalance is mainly manifested in the fact that capital inflows and outflows from some countries cannot be balanced. The United States is a consumer-oriented country with relatively little production, which leads to unbalanced capital flows. At the same time, since the US dollar itself is the mainstream international currency, it also needs to export the US dollar through trade or bonds to supply global transactions, which in turn has a complex impact on the flow of funds in the United States. Overall, global economic imbalances are the inevitable result of low domestic savings and insufficient production in the United States, and high debt to support high spending.

This is originally the United States 'own problem, but the United States hopes to "dump the blame" on China by hyping up issues such as China's so-called "economic imbalance" and "overcapacity". Of course, China will not accept it.

China's press release shows that China has also expressed serious concerns about the U.S. imposition of tariffs on China, restrictions on investment in China, Russia-related sanctions, and suppression and influence on the interests of Chinese companies.

On September 27, the United States will begin imposing tariffs of up to 100% on electric vehicles on China. The United States still uses the so-called "risk removal" and "overcapacity" to provoke trade frictions with China, and even encourages its allies to "decouple and break the chain" with China, which is undoubtedly "laying mines" for the U.S. economy and even the world economy.

Because various tariff barriers will cause a sharp rise in prices and are likely to form a chain reaction around the world. If the United States fails to cancel tariffs on China as soon as possible, the inflation that has just fallen in the United States will still face the risk of rebound.

Currently, the risks facing the U.S. economy are not limited to these-this can be seen by observing the Federal Reserve's interest rate cut.

Historically, the Federal Reserve has typically cut interest rates at a rate of 25 basis points in the absence of a recession. The direct interest rate cut by 50 basis points this time may mean that the Federal Reserve judges that the U.S. economy is at risk of recession and needs to cut interest rates quickly.

As the world's largest economy, the U.S. economy has considerable spillover effects on the world economy. Regarding these risks, China needs to understand and communicate clearly, and China and the United States must also jointly find means to resolve risks.

In addition to these topics, both China and the United States have mentioned relevant content to address global challenges in the press release of the Economic Working Group.

At present, a key issue in global challenges in the economic field is the debt problem of developing countries. This is also a global issue that has been discussed at meetings of the China-US Economic Working Group.

In terms of debt suspension, China has actively participated in discussions on G20 financial channels and has taken many practical actions. As the largest contributor to the G20 debt relief initiative, my country accounts for more than 40% of the total global debt relief and plays an active role in the debt problems of Chad, Zambia, Ghana and other countries.

In contrast, the largest creditors of many African countries come from U.S. lenders.

The interest rates of these U.S. lending institutions are high. At the same time, after the interest rates are further raised during the Federal Reserve's interest rate hike cycle, many developing countries will fall into the development traps of "unable to pay off","credit deterioration" and "financing difficulties."

After the United States entered the interest rate cut cycle, these fragile countries were unable to cope with the adjustments of external macroeconomic policies. Asset prices were low, and short-term funds took the opportunity to pour in, further exacerbating the risks and uncertainties of these countries.

Under such circumstances, the United States needs to do more on the debt problem of developing countries. At the same time, China and the United States also need to coordinate global economic governance to help developing countries weather fluctuations and risks smoothly.

The world needs communication and cooperation between China and the United States.